Abstract

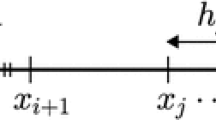

We present an accurate and efficient finite difference method for solving the Black–Scholes (BS) equation without boundary conditions. The BS equation is a backward parabolic partial differential equation for financial option pricing and hedging. When we solve the BS equation numerically, we typically need an artificial far-field boundary condition such as the Dirichlet, Neumann, linearity, or partial differential equation boundary condition. However, in this paper, we propose an explicit finite difference scheme which does not use a far-field boundary condition to solve the BS equation numerically. The main idea of the proposed method is that we reduce one or two computational grid points and only compute the updated numerical solution on that new grid points at each time step. By using this approach, we do not need a boundary condition. This procedure works because option pricing and computation of the Greeks use the values at a couple of grid points neighboring an interesting spot. To demonstrate the efficiency and accuracy of the new algorithm, we perform the numerical experiments such as pricing and computation of the Greeks of the vanilla call, cash-or-nothing, power, and powered options. The computational results show excellent agreement with analytical solutions.

Similar content being viewed by others

References

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654.

Company, R., Navarro, E., Pintos, J. R., & Ponsoda, E. (2008). Numerical solution of linear and nonlinear Black–Scholes option pricing equations. Computers & Mathematics with Applications, 56(3), 813–821.

Esser, A. (2003). General valuation principles for arbitrary payoffs and applications to power options under stochastic volatility. Financial Markets and Portfolio Management, 17(3), 351–372.

Farnoosh, R., Rezazadeh, H., Sobhani, A., & Beheshti, M. H. (2016). A Numerical method for discrete single barrier option pricing with time-dependent parameters. Computational Economics, 48(1), 131–145.

Hajipour, M., & Malek, A. (2015). Efficient high-order numerical methods for pricing of options. Computational Economics, 45(1), 31–47.

Haug, E. G. (1997). The complete guide to option pricing formulas. New York: McGraw-Hill.

Heynen, R. C., & Kat, H. M. (1996). Pricing and hedging power options. Financial Engineering and the Japanese Markets, 3(3), 253–261.

Kangro, R., & Nicolaides, R. (2000). Far field boundary conditions for Black–Scholes equations. SIAM Journal on Numerical Analysis, 38(4), 1357–1368.

Kurpiel, A., & Roncalli, T. (1999). Hopscotch methods for two-state financial models. Journal of Computational Finance, 3(2), 53–89.

Le Floc’h, F. (2014). TR-BDF2 for fast stable American option pricing. Journal of Computational Finance, 17(3), 31–56.

Linde, G., Persson, J., & von Sydow, L. (2009). A highly accurate adaptive finite difference solver for the Black–Scholes equation. International Journal of Computer Mathematics, 86(12), 2104–2121.

Lötstedt, P., Persson, J., von Sydow, L., & Tysk, J. (2007). Space–time adaptive finite difference method for European multi-asset options. Computers and Mathematics with Applications, 53(8), 1159–1180.

MathWorks, Inc. (2015). MATLAB: The language of technical computing. Natick, MA: The MathWorks. http://www.mathworks.com/.

Merton, R. C. (1973). Theory of rational option pricing. The Bell Journal of Economics and Management Science, 4(1), 141–183.

Pooley, D. M., Forsyth, P. A., & Vetzal, K. R. (2003). Numerical convergence properties of option pricing PDEs with uncertain volatility. IMA Journal of Numerical Analysis, 23(2), 241–267.

Reisinger, C., & Wittum, G. (2004). On multigrid for anisotropic equations and variational inequalities “Pricing multi-dimensional European and American options”. Computing and Visualization in Science, 7(3–4), 189–197.

Smith, R. (2000). On multigrid for anisotropic equations and variational inequalities “Pricing multi-dimensional European and American options”. Proceedings of the Royal Society of London A: Mathematical, Physical and Engineering Sciences, 456(1997), 1019–1028.

Tangman, D. Y., Gopaul, A., & Bhuruth, M. (2008). Numerical pricing of options using high-order compact finite difference schemes. Journal of Computational and Applied Mathematics, 218(2), 270–280.

Tavella, D., & Randall, C. (2000). Pricing Financial Instruments: The Finite Difference Method. New York: Wiley.

Vazquez, C. (1998). An upwind numerical approach for an American and European option pricing model. Applied Mathematics and Computation, 97(2), 273–286.

Windcliff, H., Forsyth, P. A., & Vetzal, K. R. (2004). Analysis of the stability of the linear boundary condition for the Black–Scholes equation. Journal of Computational Finance, 8, 65–92.

Zhang, P. G. (1998). A guide to second generation options. Singapore: World Scientific.

Zvan, R., Forsyth, P. A., & Vetzal, K. R. (1998). Robust numerical methods for PDE models of Asian options. Journal of Computational Finance, 1, 39–78.

Acknowledgements

The authors (D. Jeong and J.S. Kim) thank the Korea Institute for Advanced Study (KIAS) for supporting research on the financial pricing model using artificial intelligence. The corresponding author (J.S. Kim) was supported by a subproject of project Research for Applications of Mathematical Principles (No. C21501) and supported by the National Institute of Mathematics Sciences (NIMS). The authors are grateful to the anonymous referees whose valuable suggestions and comments significantly improved the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jeong, D., Yoo, M. & Kim, J. Finite Difference Method for the Black–Scholes Equation Without Boundary Conditions. Comput Econ 51, 961–972 (2018). https://doi.org/10.1007/s10614-017-9653-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9653-0